carried interest tax rate 2021

A key exemption from these rules is the carried interest exemption which if met. Carried interest offers lower tax rate than for income.

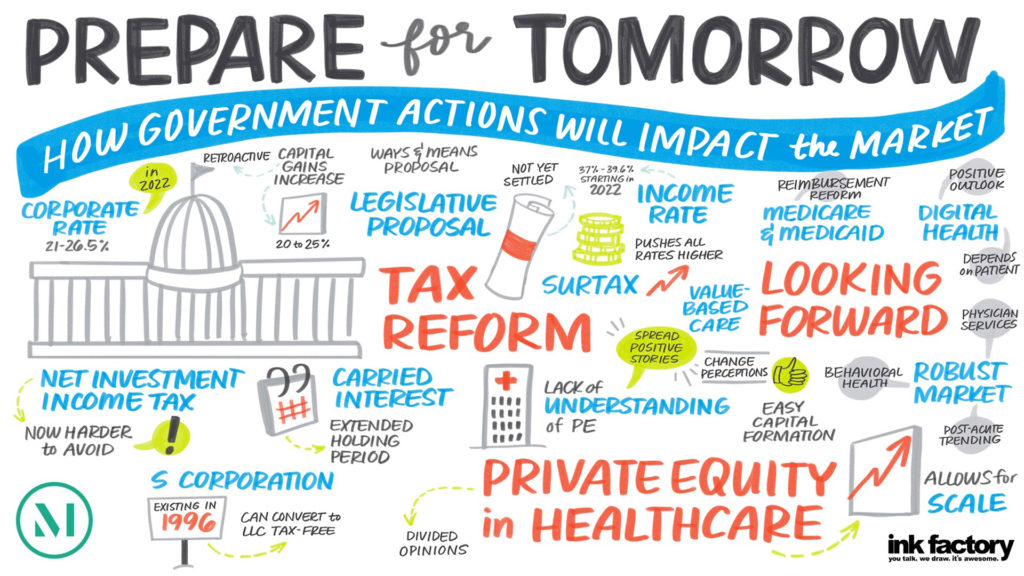

Hpe New York 2021 Prepare For Tomorrow Health Life Sciences News

Some view this tax treatment as unfai See more.

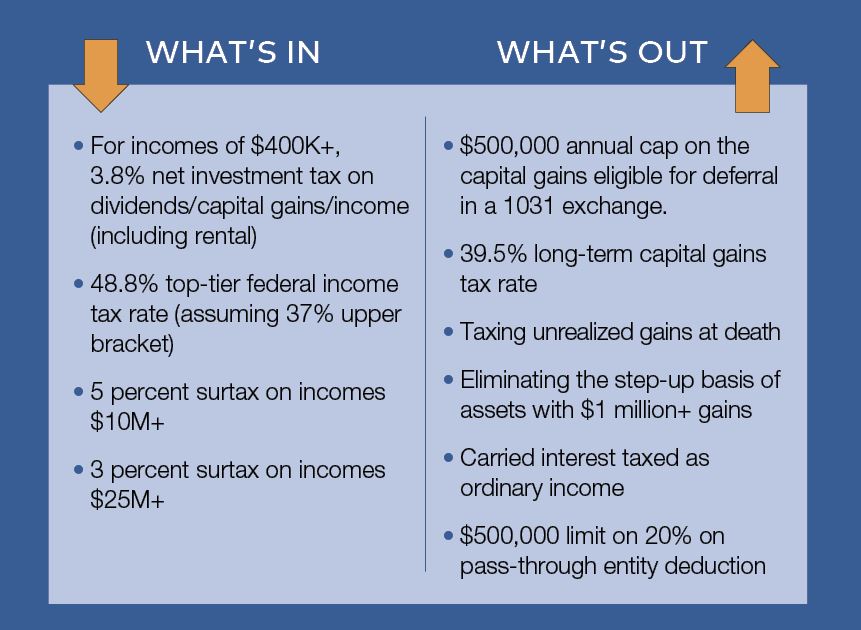

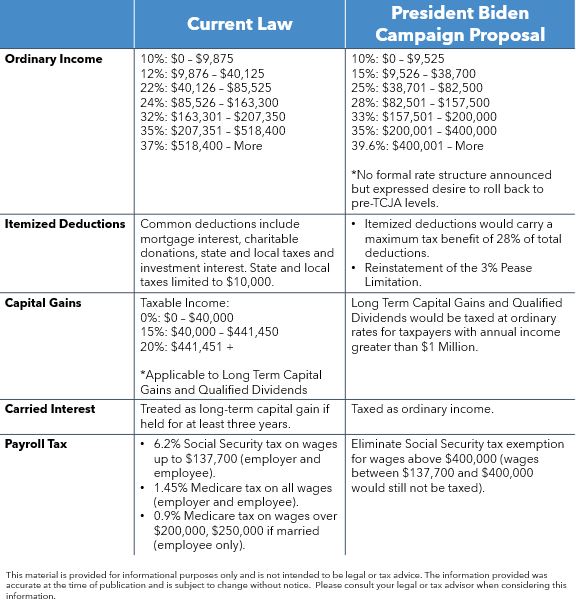

. President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20 today. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM. Taxation of Carried Interest Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20 compared with the 37.

Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown. A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it would not share in. Carried Interest Fairness Act of 2021.

24 2021 430 am ET Order Reprints Print Article Every president since George W. Not including residential property and carried interest. Carried-Interest Tax Break for Private Equity Survives Another Attempt to Kill It By Bill Alpert Sept.

News June 30 2021 at 0208 PM Share Print. 18 and 28 tax rates for individuals for residential property and. However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment income tax.

A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it would not share in. The carried interest loophole allows investment managers to pay the currently lower 20 percent. Managers with a holding period of less than five years would incur short-term capital gains tax rates on carried interest a 37 top rate the same that applies to wage and salary.

Annual management fees are taxed as ordinary income currently subject to a top tax rate of 37. As many of you are probably aware on August 14th 2020 Department of Treasury published proposed regulations under Section 1061 of the Internal Revenue Code IRC. 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018.

Tax incentives include 0 tax rate for carried interest May 4 2021 The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its. The proposed carried-interest change would include some exceptions retaining the three-year holding period for real property trades or. The top individual rate would be 396.

Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather than. This bill modifies the tax treatment of carried interest which is compensation that is typically received by a partner of a private equity or. The Carried Interest Exemption Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the underlying.

Study Raising Taxes On Carried Interest Capital Gains Will Eliminate 4 9 Million Jobs Americans For Tax Reform

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DCYDKFTNRNP3DPHSEWGG4UD2UM.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

What The Proposed Tax Plan Means For Commercial Real Estate Voit Real Estate Services

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

State Taxes On Capital Gains Center On Budget And Policy Priorities

Carried Interest In Venture Capital Angellist Venture

Investment Expenses What S Tax Deductible Charles Schwab

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Schedule K 1 For Vcs Angellist Venture

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

The Corporate Tax Burden Facts And Fiction Seeking Alpha

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

What Carried Interest Is And How It Benefits High Income Taxpayers

Scanning The Horizon In A Sea Of Noise Rockefeller Capital Management

Carried Interest Explained Who It Benefits And How It Works

Carried Interest Taxation Update On Final Regulations And Potential Legislative Changes Gray Reed Jdsupra